A fork in the road for energy storage

We are becoming accustomed to record-breaking years for energy storage, and 2024 was no exception. Manufacturer Tesla deployed 31.4 GWh, up 213% from 2023, and market intelligence provider Bloomberg New Energy Finance raised its forecast twice, ending the year predicting almost 2.4 TWh of battery energy storage by 2030. That is likely an underestimate.

Positive feedback loops and exponential growth are notoriously hard to predict. Humans are not well set up to process exponents. In 2019, pumped hydro storage (PHS) supplied 90% of global energy storage power output (measured in gigawatts), but batteries are set to overtake that in 2025 and its related energy storage capacity, in gigawatt-hours, by 2030.

Batteries are a technology, not a fuel, and follow a price-reduction “learning rate” more like that of semiconductors of solar equipment than that of traditional energy assets. Battery cell costs have fallen about 29% for every doubling of market size in recent decades, according to researchers at the RMI think tank.

A new generation of “3xx Ah” lithium ferro-phosphate (LFP) cells – 305Ah, 306Ah, 314Ah, 320Ah – has entered production, offering higher energy density and lower unit costs than 280Ah cells. They needed minimal production line reconfiguration due to a similar prismatic form factor.

Slower-than-expected electric vehicle (EV) demand has caused oversupply, further depressing battery raw material prices and sparking intense price competition. In 2024, average energy storage system (ESS) pricing fell 40% to $165/kWh, the steepest decline on record. Chinese costs are significantly lower, as a 16 GWh PowerChina tender saw ESS prices averaging $66.3/kWh in December 2024.

Long-duration leapfrogging

Falling cell costs disproportionately benefit longer-duration energy storage systems. These projects, with higher cell-cost components, are becoming viable more quickly than expected, so sites with longer-duration storage are “leapfrogging” one- to two-hour batteries for grid frequency regulation and load shifting in the United States and Australia.

Saudi Arabia’s Red Sea Project, for example, now hosts “the world’s largest microgrid” – a 400 MW solar and 225 MW/1.3 GWh battery energy storage system (BESS).

Saudi Arabia has 33.5 GWh of batteries in operation, under construction, or tendered – all with four- to five-hour storage duration – and a further 34 GWh planned under its Vision 2030 energy strategy. That could place Saudi Arabia among the top five energy storage markets globally by 2026. Similar dynamics are likely across the Middle East and North Africa (MENA) sunbelt, from Morocco to the United Arab Emirates, positioning the region as a clean energy exporter and all largely under the radar of forecasters, thanks to the speed of the development.

Local and global

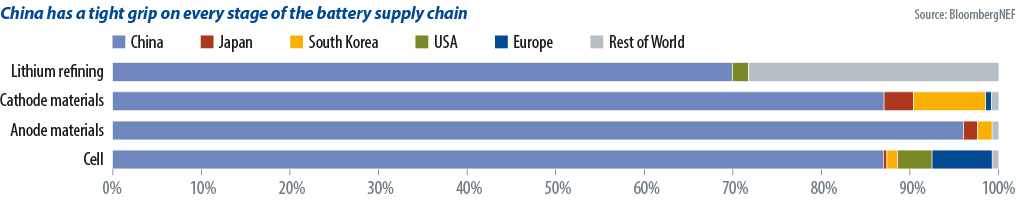

Despite promising trends, battery supply chains remain dominated by China. Attempts to shore up regional supply chains have largely struggled to compete. The collapse of Britishvolt in the United Kingdom and the bankruptcy protection filing of Northvolt in the European Union serve as clear examples. That has not stopped battery supply chain efforts amid a more protectionist world.

The US Inflation Reduction Act incentivized local BESS manufacturing and import duties on Chinese products aim to create jobs and reduce reliance on imports. Those measures risk slower adoption of grid-scale energy storage and EVs, however, due to higher near-term costs.

China has retaliated by mooting a plan to ban the export of cathode and anode production equipment as well as lithium extraction and refinement technology. Even if ESS and battery cell manufacturing is localized, raw materials will still be concentrated in China, moving the bottleneck upstream.

In 2025, the global energy storage market may split in two. Protectionist markets such as the United States, India, and MENA will prioritize localized supply chains for job creation while the Global South will focus on tariff-free imports, to drive affordability and economic growth.

That dynamic echoes historic globalization debates such as the Corn Laws of the 1800s. The energy storage sector faces similar tensions between trade-driven innovation and the risks of economic inequality and job displacement.

Path forward

The year 2025, therefore, will mark another inflection point for the energy storage industry. As technological advancement and falling costs accelerate adoption and bring forward longer-duration storage, as well as the feasibility of a 100%-renewables grid, markets are increasingly poised to redefine their energy landscapes. The global race for supply chain dominance underscores how energy storage is no longer just a supportive technology, but a central pillar of the energy transition.

The division of global supply chains, spurred by protectionist policies, raises pressing questions about energy equity and innovation. Will the push for localized manufacturing drive resilience or will it slow progress in markets that depend on affordable imports and just shift the “choke point” further upstream?

In navigating these dynamics, the energy storage sector has the potential to do more than power economies – it can set a precedent for how industries can balance competition, cooperation, and sustainability in the face of global challenges. The decisions made today will resonate well beyond 2025, shaping not only the energy transition, but the broader socioeconomic trajectory of the decades to come.

Post time: Feb-18-2025