What is Industrial and Commercial Energy Storage and Common Business Models

I. Industrial and Commercial Energy Storage

“Industrial and commercial energy storage” refers to energy storage systems used in industrial or commercial facilities.

From the perspective of end-users, energy storage can be categorized into power-side, grid-side, and user-side energy storage. Power-side and grid-side energy storage are also known as pre-meter energy storage or bulk storage, while user-side energy storage is referred to as post-meter energy storage. User-side energy storage can be further divided into industrial and commercial energy storage and household energy storage. In essence, industrial and commercial energy storage falls under user-side energy storage, catering to industrial or commercial facilities. Industrial and commercial energy storage finds applications in various settings, including industrial parks, commercial centers, data centers, communication base stations, administrative buildings, hospitals, schools, and residential buildings.

From a technical perspective, the architecture of industrial and commercial energy storage systems can be classified into two types: DC-coupled systems and AC-coupled systems. DC-coupling systems typically utilize integrated photovoltaic storage systems, consisting of various components such as photovoltaic power generation systems (mainly comprising photovoltaic modules and controllers), energy storage power generation systems (mainly including battery packs, bidirectional converters (“PCS”), battery management systems (“BMS”), achieving the integration of photovoltaic power generation and storage), energy management systems (“EMS systems”), etc.

The fundamental operational principle involves the direct charging of battery packs with DC power generated by photovoltaic modules through photovoltaic controllers. Additionally, AC power from the grid can be converted into DC power through PCS to charge the battery pack. When there is a demand for electricity from the load, the battery releases current, with the energy collection point being at the battery end. On the other hand, AC-coupling systems comprise several components, including photovoltaic power generation systems (mainly comprising photovoltaic modules and grid-connected inverters), energy storage power generation systems (mainly including battery packs, PCS, BMS, etc.), EMS system, etc.

The basic operational principle involves converting DC power generated by photovoltaic modules into AC power through grid-connected inverters, which can be directly supplied to the grid or electrical loads. Alternatively, it can be converted into DC power through PCS and charged to the battery pack. At this stage, the energy collection point is at the AC end. DC coupling systems are known for their cost-effectiveness and flexibility, suitable for scenarios where users consume less electricity during the day and more at night. On the other hand, AC coupling systems are characterized by higher costs and flexibility, ideal for applications where photovoltaic power generation systems are already in place or where users consume more electricity during the day and less at night.

In general, the architecture of industrial and commercial energy storage systems can operate independently from the main power grid and form a microgrid for photovoltaic power generation and battery storage.

II. Peak Valley Arbitrage

Peak valley arbitrage is a commonly used revenue model for industrial and commercial energy storage, involving charging from the grid at low electricity prices and discharging at high electricity prices.

Taking China as an example, its industrial and commercial sectors typically implement time-of-use electricity pricing policies and peak electricity pricing policies. For instance, in the Shanghai region, the Shanghai Development and Reform Commission issued a notice to further enhance the time-of-use electricity pricing mechanism in the city (Shanghai Development and Reform Commission [2022] No. 50). According to the notice:

For general industrial and commercial purposes, as well as other two-part and large industrial two-part electricity consumption, the peak period is from 19:00 to 21:00 in winter (January and December) and from 12:00 to 14:00 in summer (July and August).

During peak periods in summer (July, August, September) and winter (January, December), electricity prices will rise by 80% based on the flat price. Conversely, during low periods, electricity prices will decrease by 60% based on the flat price. Additionally, during peak periods, electricity prices will increase by 25% based on the peak price.

In other months during peak periods, electricity prices will increase by 60% based on the flat price, while during low periods, prices will decrease by 50% based on the flat price.

For general industrial, commercial, and other single-system electricity consumption, only peak and valley hours are distinguished without further division of peak hours. During peak periods in summer (July, August, September) and winter (January, December), electricity prices will rise by 20% based on the flat price, while during low periods, prices will decrease by 45% based on the flat price. In other months during peak hours, electricity prices will increase by 17% based on the flat price, while during low periods, prices will decrease by 45% based on the flat price.

Industrial and commercial energy storage systems leverage this pricing structure by purchasing low-priced electricity during off-peak hours and supplying it to the load during peak or high-priced electricity periods. This practice helps reduce enterprise electricity expenses.

III. Energy Time Shift

“Energy time shift” involves adjusting the timing of electricity consumption through energy storage to smooth out peak demands and fill in low-demand periods. When utilizing power generation equipment like photovoltaic cells, the mismatch between the generation curve and the load consumption curve can lead to situations where users either sell excess electricity to the grid at lower prices or buy electricity from the grid at higher prices.

To address this, users can charge the battery during times of low electricity consumption and discharge stored electricity during peak consumption periods. This strategy aims to maximize economic benefits and reduce corporate carbon emissions. Additionally, saving surplus wind and solar energy from renewable sources for later use during peak demand periods is also considered an energy time shift practice.

Energy time shift does not have strict requirements regarding charging and discharging schedules, and the power parameters for these processes are relatively flexible, making it a versatile solution with a high frequency of application.

IV. Common business models for industrial and commercial energy storage

1. Subject Involved

As mentioned earlier, the core of industrial and commercial energy storage lies in utilizing energy storage facilities and services, and obtaining energy storage benefits through peak valley arbitrage and other methods. And around this chain, the main participants include equipment provider, energy service provider, financing leasing party, and user:

|

Subject |

Definition |

|

Equipment provider |

The energy storage system/equipment provider. |

|

Energy service provider |

The main body that utilizes energy storage systems to provide relevant energy storage services to users, usually energy groups and energy storage equipment manufacturers with rich experience in energy storage construction and operation, is the protagonist of the business scenario of the contract energy management model (as defined below). |

|

Financial leasing party |

Under the “Contract Energy Management+Financial Leasing” model (as defined below), the entity that enjoys ownership of energy storage facilities during the lease term and provides users with the right to use energy storage facilities and/or energy services. |

|

User |

The energy consuming unit. |

2. Common Business Models

At present, there are four common business models for industrial and commercial energy storage, namely the “user self investment” model, the “pure leasing” model, the “contract energy management” model, and the “contract energy management+financing leasing” model. We have summarized this as follows:

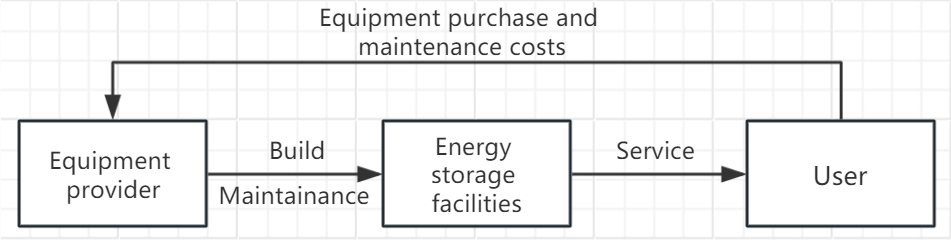

(1) Use Investment

Under the user self investment model, the user purchases and installs energy storage systems on their own to enjoy energy storage benefits, mainly through peak valley arbitrage. In this mode, although the user can directly reduce peak shaving and valley filling, and reduce electricity costs, they still need to bear the initial investment cost and daily operation and maintenance expenses. The business model diagram is as follows:

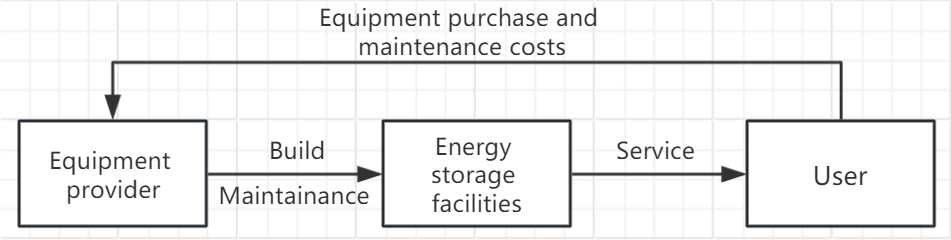

(2) Pure Leasing

In the pure leasing mode, the user does not need to purchase energy storage facilities on their own. They only need to rent energy storage facilities from the equipment provider and pay corresponding fees. The equipment provider provides construction, operation and maintenance services to the user, and the energy storage revenue generated from this is enjoyed by the user. The business model diagram is as follows:

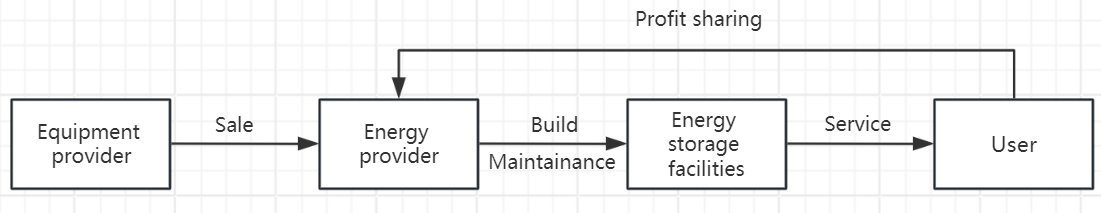

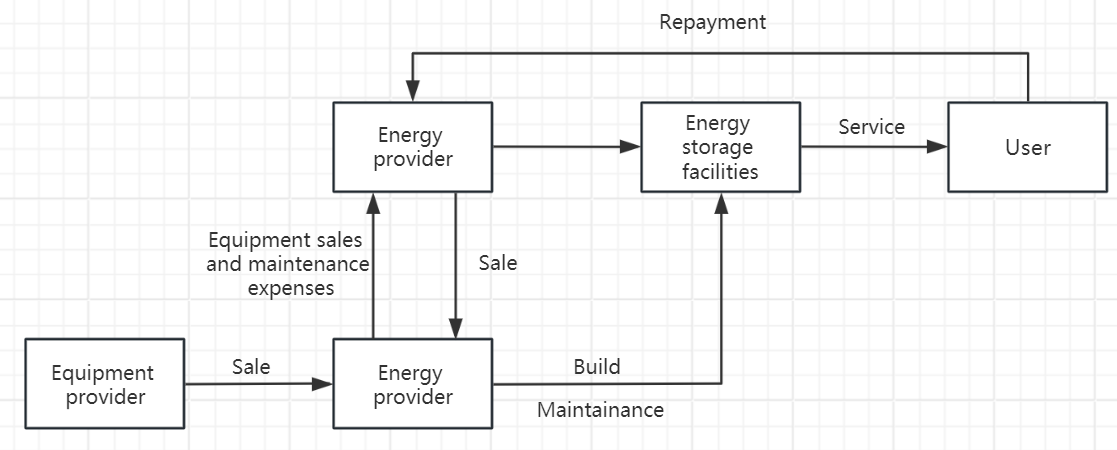

(3) Contract Energy Management

Under the contract energy management model, the energy service provider invests in purchasing energy storage facilities and provides them to users in the form of energy services. The energy service provider and the user share the benefits of energy storage in an agreed manner (including profit sharing, electricity price discounts, etc.), that is, using the energy storage power station system to store electrical energy during valley or normal electricity price periods, and then supplying power to the user’s load during peak electricity price periods. The user and the energy service provider then share the energy storage benefits in the agreed proportion. Compared to the user self investment model, this model introduces energy service providers who provide corresponding energy storage services. Energy service providers play the role of investors in the contract energy management model, which to some extent reduces the investment pressure on users. The business model diagram is as follows:

(4) Contract Energy Management+Financing Leasing

The “Contract Energy Management+Financial Leasing” model refers to the introduction of a financial leasing party as the lessor of energy storage facilities and/or energy services under the Contract Energy Management model. Compared with the contract energy management model, the introduction of financing leasing parties to purchase energy storage facilities greatly reduces the financial pressure on energy service providers, thus enabling them to better focus on contract energy management services.

The “Contract Energy Management+Financial Leasing” model is relatively complex and has multiple sub models. For example, one common sub model is that the energy service provider obtains energy storage facilities from the equipment provider first, and then the financial leasing party selects and purchases energy storage facilities according to their agreement with the user, and leases the energy storage facilities to the user.

During the lease period, the ownership of the energy storage facilities belongs to the financing leasing party, and the user has the right to use them. After the expiration of the lease term, the user can obtain ownership of the energy storage facilities. The energy service provider mainly provides energy storage facility construction, operation and maintenance services to the users, and can obtain corresponding consideration from the financing leasing party for equipment sales and operation. The business model diagram is as follows:

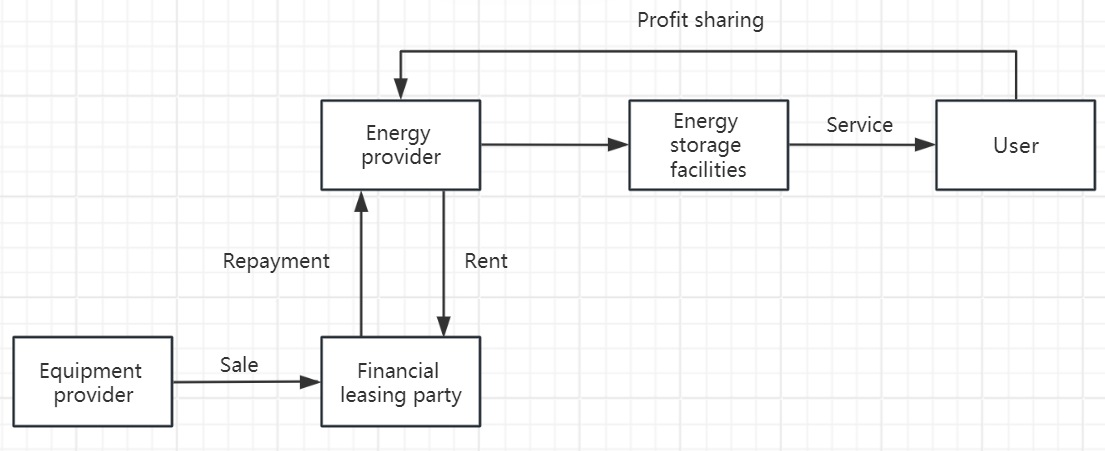

Unlike the previous seed model, in the other seed model, the financial leasing party directly invests in the energy service provider, rather than the user. Specifically, the financing leasing party selects and purchases energy storage facilities from the equipment provider according to its agreement with the energy service provider, and leases the energy storage facilities to the energy service provider.

The energy service provider can use such energy storage facilities to provide energy services to the users, share the energy storage benefits with the users in the agreed proportion, and then repay the financing leasing party with a portion of the benefits. After the lease term expires, the energy service provider obtains ownership of the energy storage facility. The business model diagram is as follows:

V. Common Business Agreements

In the discussed model, the primary business protocols and related aspects are outlined as follows:

1.Cooperation Framework Agreement:

Entities may enter into a cooperation framework agreement to establish a framework for cooperation. For instance, in the contract energy management model, the energy service provider can sign such an agreement with the equipment provider, outlining responsibilities such as the construction and operation of the energy storage system.

2.Energy Management Agreement for Energy Storage Systems:

This agreement typically applies to the contract energy management model and the “contract energy management + financing leasing” model. It involves the provision of energy management services by the energy service provider to the user, with corresponding benefits accruing to the user. Responsibilities include payments from the user and project development cooperation, while the energy service provider handles design, construction, and operation.

3.Equipment Sales Agreement:

Except for the pure leasing model, equipment sales agreements are relevant in all commercial energy storage models. For instance, in the user self-investment model, agreements are made with equipment suppliers for the purchase and installation of energy storage facilities. Quality assurance, compliance with standards, and after-sales service are crucial considerations.

4.Technical Service Agreement:

This agreement is typically signed with the equipment provider to deliver technical services such as system design, installation, operation, and maintenance. Clear service requirements and compliance with standards are essential aspects to be addressed in technical service agreements.

5.Equipment Lease Agreement:

In scenarios where equipment providers retain ownership of energy storage facilities, equipment leasing agreements are signed between users and providers. These agreements outline user responsibilities for maintaining and ensuring the normal operation of the facilities.

6.Financing Lease Agreement:

In the “Contract Energy Management + Financial Leasing” model, a financial leasing agreement is commonly established between users or energy service providers and financial leasing parties. This agreement governs the purchase and provision of energy storage facilities, ownership rights during and after the lease term, and considerations for selecting suitable energy storage facilities for home users or energy service providers.

VI. Special precautions for energy service providers

Energy service providers play a significant role in the chain of achieving industrial and commercial energy storage and obtaining energy storage benefits. For energy service providers, there are a series of issues that need special attention under industrial and commercial energy storage, such as project preparation, project financing, facility procurement and installation. We briefly list these issues as follows:

|

Project Phase |

Specific matters |

Description |

|

Project development |

User’s choice |

As the actual energy consuming unit in energy storage projects, the user has a good economic foundation, development prospects, and credibility, which can greatly ensure the smooth implementation of energy storage projects. Therefore, energy service providers should make reasonable and cautious choices to users during the project development phase through due diligence and other means. |

|

Finance leasing |

Although investing in energy storage projects by financing lessors can greatly alleviate the financial pressure on energy service providers, energy service providers should still be cautious when selecting financing lessors and signing agreements with them. For example, in a financing lease agreement, clear provisions should be made regarding the lease term, payment terms and methods, ownership of the leased property at the end of the lease term, and liability for breach of contract for the leased property (i.e. energy storage facilities). |

|

|

Preferential policy |

Due to the fact that the implementation of industrial and commercial energy storage largely depends on factors such as price differences between peak and valley electricity prices, prioritizing the selection of regions with more favorable local subsidy policies during the project development phase will help facilitate the smooth implementation of the project. |

|

|

project implementation |

Project filing |

Before the formal commencement of the project, the specific procedures such as project filing should be determined according to the local policies of the project. |

|

Facility procurement |

Energy storage facilities, as the foundation for achieving industrial and commercial energy storage, should be purchased with special attention. The corresponding functions and specifications of the required energy storage facilities should be determined based on the specific needs of the project, and the normal and effective operation of the energy storage facilities should be ensured through agreements, acceptance, and other methods. |

|

|

Facility installation |

As mentioned above, energy storage facilities are usually installed at the user’s premises, so the energy service provider should clearly specify the specific matters such as the use of the project site in the agreement signed with the user to ensure that the energy service provider can smoothly carry out construction at the user’s premises. |

|

|

Actual energy storage revenue |

During the actual implementation of energy storage projects, there may be situations where the actual energy-saving benefits are luser than the expected benefits. The energy service provider can allocate these risks reasonably among project entities through contract agreements and other means. |

|

|

Project completion |

Completion procedures |

When the energy storage project is completed, the engineering acceptance should be carried out in accordance with the relevant regulations of the construction project and a completion acceptance report should be issued. At the same time, the grid connection acceptance and engineering fire protection acceptance procedures should be completed according to the specific local policy requirements of the project. For energy service providers, it is necessary to clearly specify the acceptance time, location, method, standards, and breach of contract responsibilities in the contract to avoid additional losses caused by unclear agreements. |

|

Profit sharing |

The benefits of energy service providers typically include sharing energy storage benefits with users in a proportionate manner as agreed, as well as expenses related to the sale or operation of energy storage facilities. Therefore, energy service providers should, on the one hand, agree on specific matters related to revenue sharing in relevant agreements (such as revenue base, revenue sharing ratio, settlement time, reconciliation terms, etc.), and on the other hand, pay attention to the progress of revenue sharing after the energy storage facilities are actually put into use to avoid delays in project settlement and resulting in additional losses. |

Post time: Jun-03-2024